ending work in process inventory calculation

Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net. During the year 150000 is spent on manufacturing.

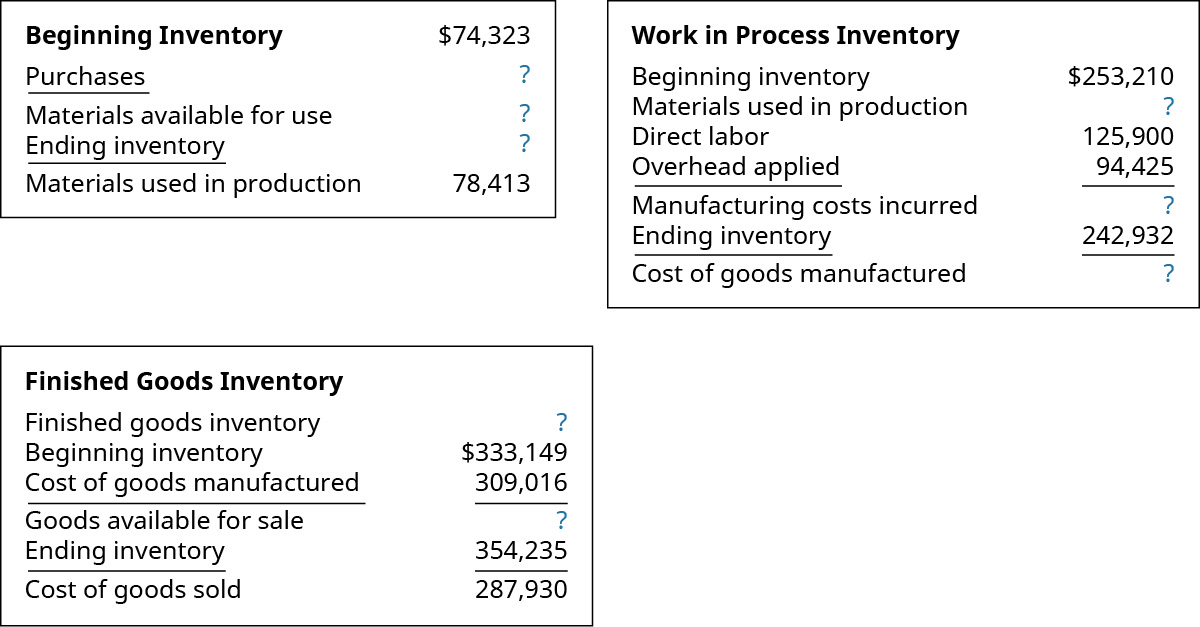

Compute The Cost Of A Job Using Job Order Costing Principles Of Accounting Volume 2 Managerial Accounting

It is essential for any.

. How to Calculate Ending Work In Process Inventory The work in process formula is. Ending WIP Beginning WIP Materials in Direct Labor Overheads - COGM Ending WIP 25000 40000 10000 5000 - 45000 Ending WIP 35000 Again this can be. Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs - Cost of Finished Goods Lets use.

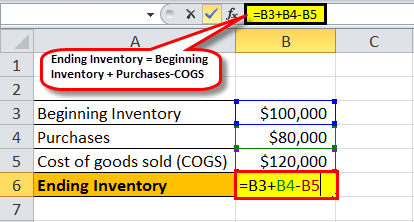

The basic formula for calculating ending inventory is. Formulas to Calculate Work in Process. The calculation of ending work in process is.

Your beginning inventory is the last periods ending. Beginning inventory net purchases COGS ending inventory. Beginning inventory net purchases COGS ending inventory.

The last quarters ending work in process inventory stands at 10000. Here is the basic formula you can use to calculate a companys ending inventory. Find the cost of goods available.

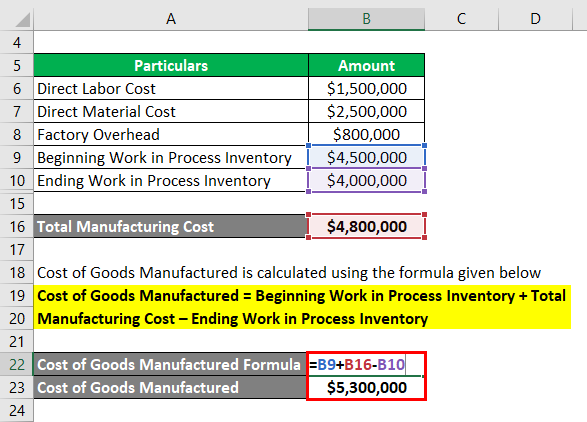

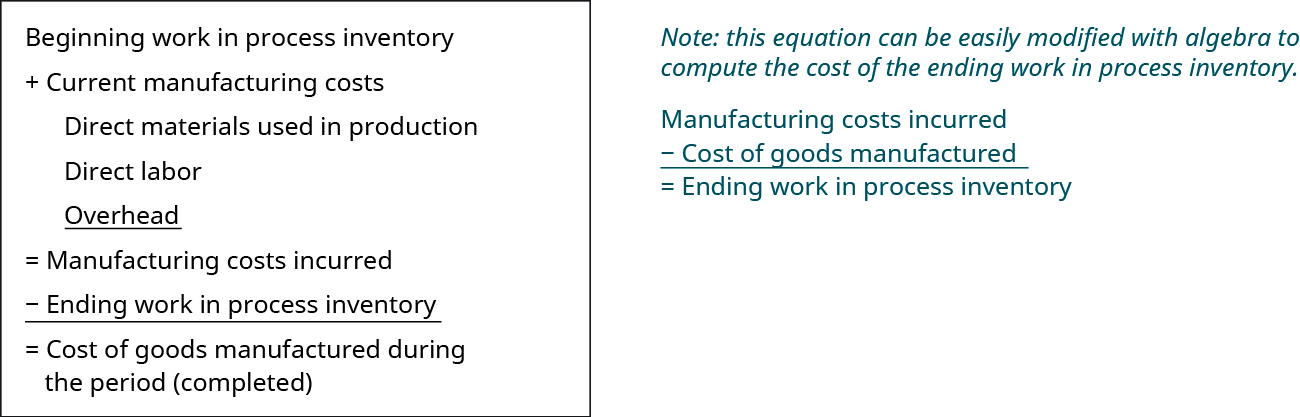

Beginning WIP Manufacturing Costs - Cost of Goods Manufactured Ending Work in Process It is important to note that the. This leaves your ending WIP inventory as. It will consist of finished semi-finished and.

Global Tech News Daily. To calculate beginning WIP inventory determine the ending WIPs inventory from the prior period and bring it over as the beginning figure of the new financial period. The amount of ending work in process must be derived as part of the period-end closing process and is.

Add total WIP costs 4109350. Beginning work-in-progress inventory 2856000. WORK IN PROCESS INITIAL WORK IN PROCESS DIRECT LABOR OVERHEAD - COST OF FINISHED GOODS.

These include white papers government data original reporting and interviews with industry experts. WIP inventory example 2 For. To calculate your in-process inventory the following WIP inventory formula is followed.

WIP e WIP b C m - C c. WIP b beginning work in process. Calculate the ending Work in Process Inventory balance on June 30.

When you are ready to calculate work in process inventory you must calculate it based off of the cost of production to the point where of the processes had first come to a halt. Beginning WIP Inventory Manufacturing Costs COGM Ending WIP Inventory 110000 150000 250000 10000. Beginning WIP DM DL MOH Cost of goods manufactured Ending WIP.

The work in process formula is expressed as. The calculation to find the work-in-progress inventory at the end of the year is as follows. One may also ask what is.

The ending WIP beginning WIP manufacturing costs - cost of goods produced This represents the value of the partially. WIP Inventory Example 2. You can do this by adding the cost of your.

Ending WIP Inventory Beginning WIP Inventory Manufacturing Costs- Ending WIP. The formula for ending work in process is relatively simple. Here are the steps for using the gross profit method of calculating ending inventory.

First determine the inventory of the company at the beginning of the year from the stock book and confirm with the accounts department. 3 Methods to Calculate the Ending Inventory 1 FIFO First in First Out Method 2 LIFO Last in First Out Method 3 Weighted Average Cost Method. Work in process WIP is inventory that has been partially completed but which requires additional processing before it can be classified as finished goods inventory.

So your ending work in process inventory is 10000. Ending WIP Inventory Beginning WIP Inventory Production Costs Finished Goods Cost Work in process inventory formula in action Lets say you start the year with 10000 worth of. In this equation WIP e ending work in process.

As determined by previous accounting records your companys beginning WIP is 115000.

Ending Inventory Formula Step By Step Calculation Examples

Cost Of Goods Manufactured Cogm How To Calculate Cogm

Ending Inventory Formula Step By Step Calculation Examples

Manufacturing Account Format Double Entry Bookkeeping

Cost Of Goods Manufactured Formula Examples With Excel Template

Inventory Formula Inventory Calculator Excel Template

Ending Work In Process Double Entry Bookkeeping

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

What Is Work In Process Wip Inventory How To Calculate It Ware2go

Cost Of Goods Manufactured Formula Examples With Excel Template

Use The Job Order Costing Method To Trace The Flow Of Product Costs Through The Inventory Accounts Principles Of Accounting Volume 2 Managerial Accounting

Work In Progress Wip Definition Example Finance Strategists

Work In Process Wip Inventory Youtube

Manufacturing And Non Manufacturing Costs Online Accounting Tutorial Questions Simplestudies Com

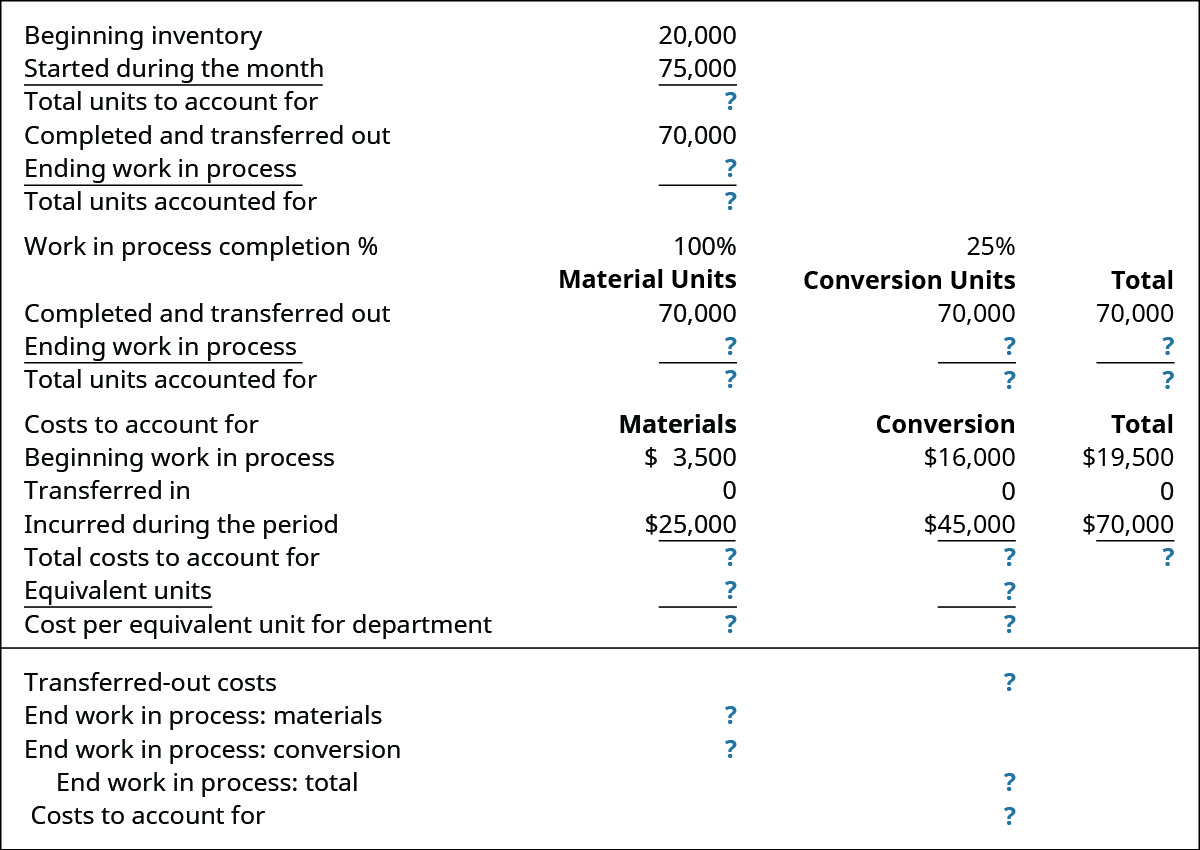

Explain And Compute Equivalent Units And Total Cost Of Production In A Subsequent Processing Stage Principles Of Accounting Volume 2 Managerial Accounting

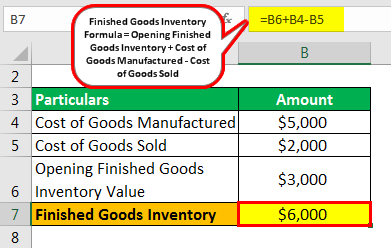

Finished Goods Inventory How To Calculate Finished Goods Inventory

Cost Of Goods Manufactured Formula Examples With Excel Template

Wip Inventory Definition Examples Of Work In Progress Inventory